Accounting & Bookkeeping Template: Income, Expense, Budget, Inventory, Google Sheets

$3.99

What sets us apart is not just our experience but also our recognition as QuickBooks ProAdvisors.

This prestigious badge from Intuit QuickBooks demonstrates our in-depth knowledge and expertise in using QuickBooks, one of the most trusted and widely used accounting software solutions.

As ProAdvisors, we’ve been trained and certified to provide expert guidance and support.

After your purchase, we will send you an email with a direct download link, ensuring you have quick access to your digital product.

- Expertise: Benefit from our professional experience.

- QuickBooks ProAdvisor: Certified in QuickBooks.

- Tailored Templates: Precise and user-friendly.

- Instant Access: Download instantly.

- Ongoing Support: We’re here when you need us.

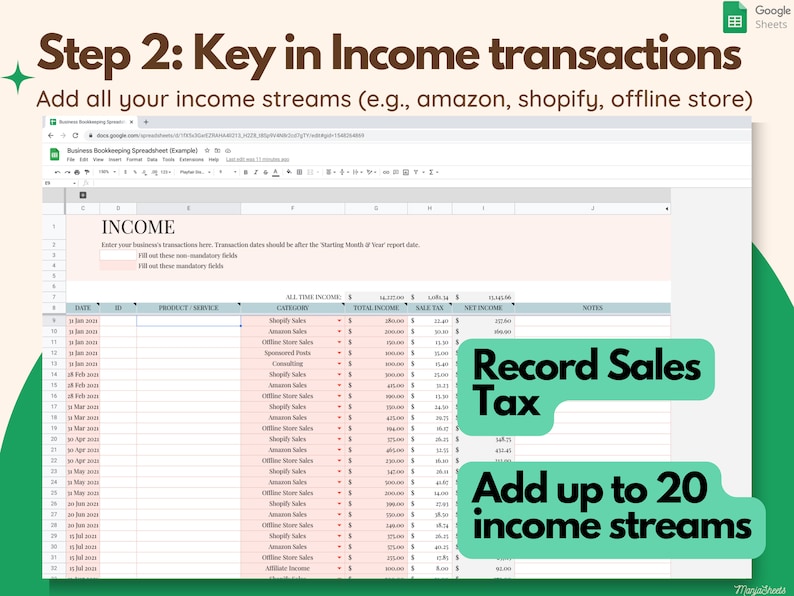

Income Tracker: Allows users to record and track multiple income streams from various sources. It may support up to 20 different income categories and helps monitor sales tax received.

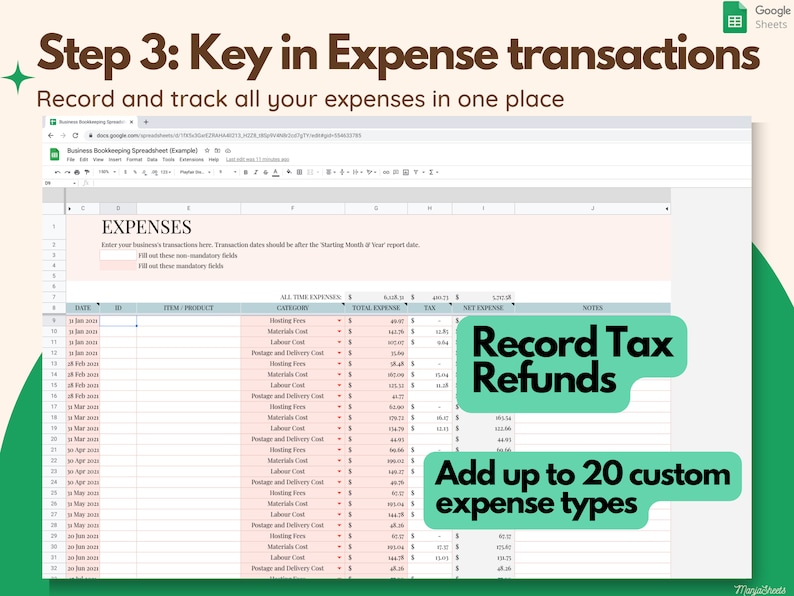

Expense Tracker: Enables users to record and track various types of expenses related to the business. It may support up to 20 different expense categories and help in monitoring sales tax paid and eligibility for refunds in certain tax jurisdictions.

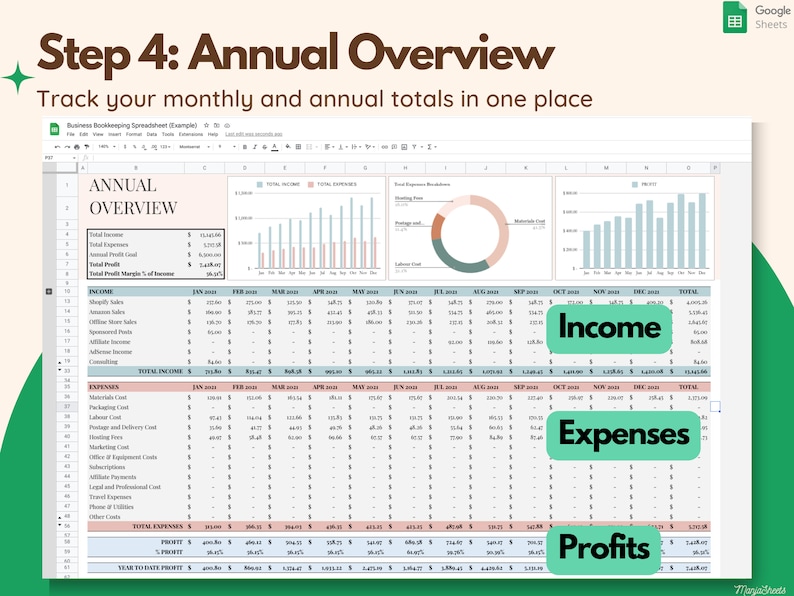

Annual Overview: Provides a comprehensive annual summary of income, expenses, and profits, giving users insights into their financial performance over the year.

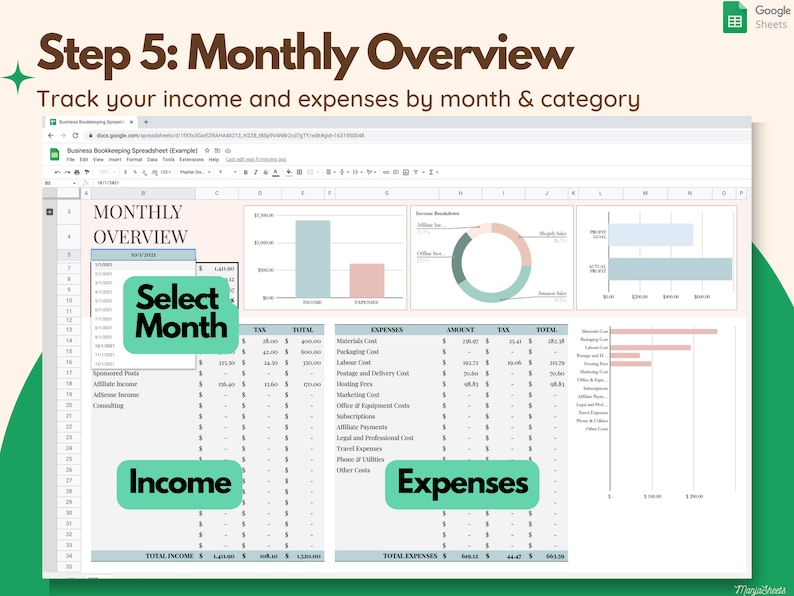

Monthly Analysis: Allows for a detailed examination of a specific month’s income, expenses, and profits, aiding users in identifying trends and making informed financial decisions.

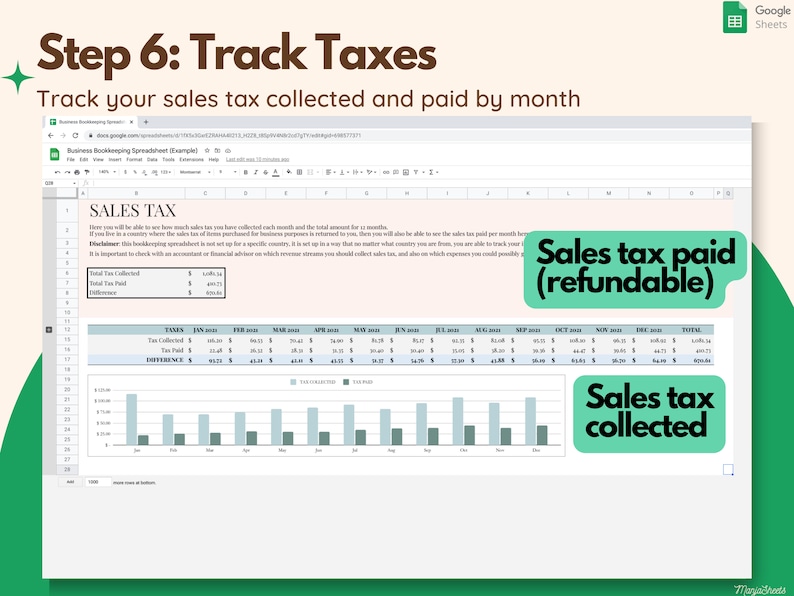

Tax Tracking: Provides tools for tracking taxes collected and paid on a monthly basis, ensuring compliance with tax regulations and accurate financial reporting.

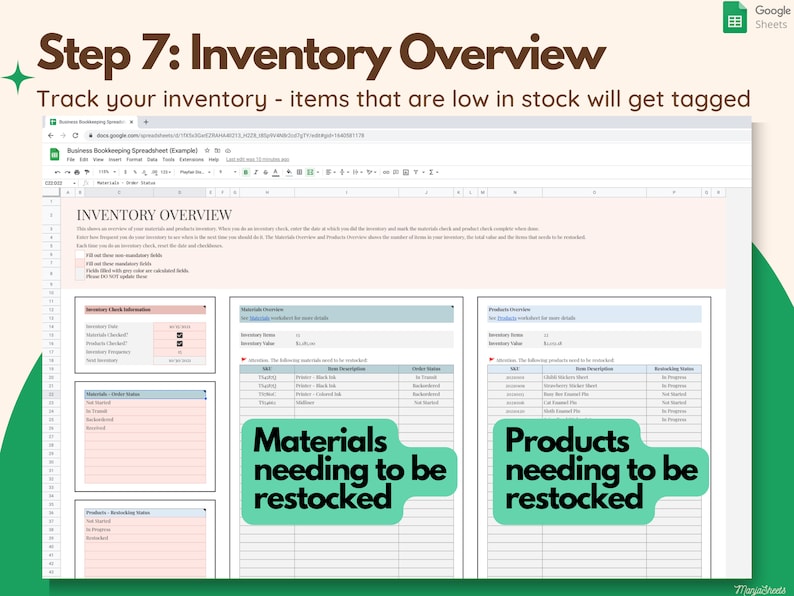

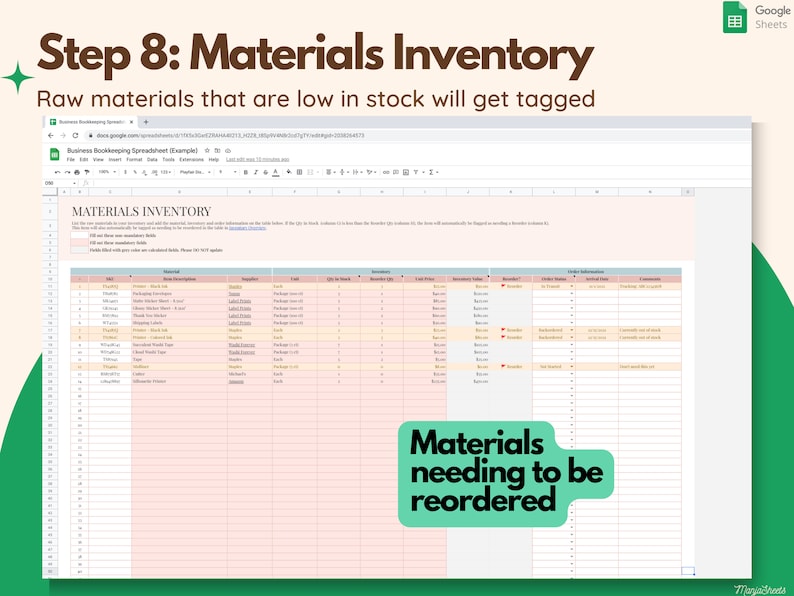

Inventory Management: Includes an inventory template that assists in organizing and tracking materials and product inventories. It may offer features to automatically tag items needing restocking.

Google Sheets Compatibility: The template is designed for Google Sheets, offering the advantages of real-time collaboration, cloud storage, and accessibility on various devices.

Digital Product: It is a digital product available for instant download after purchase, making it convenient and accessible to users.

User-Friendly: The template is designed to be user-friendly, catering to individuals with varying levels of accounting and bookkeeping expertise.

Professional Design: The template is professionally designed to ensure precision and efficiency in financial tracking and reporting.

Description

Accounting & Bookkeeping Template: Income, Expense, Budget, Inventory, Google Sheets

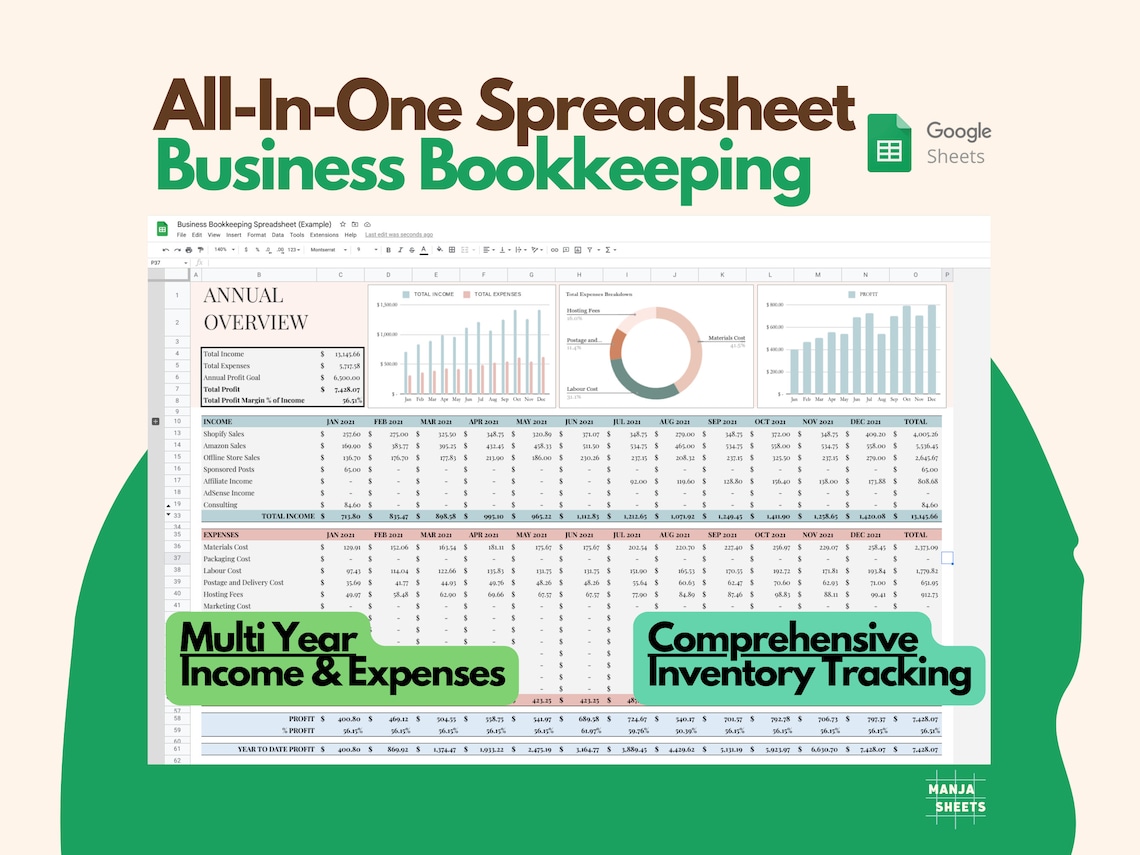

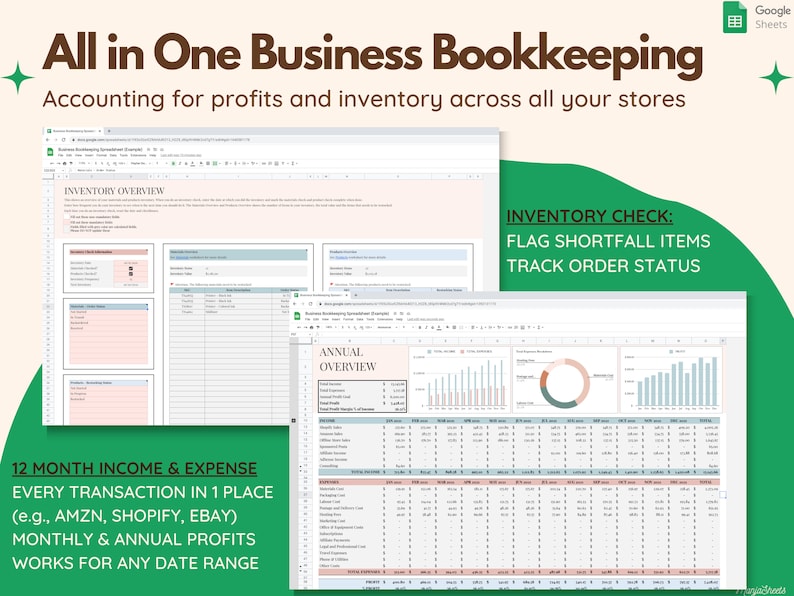

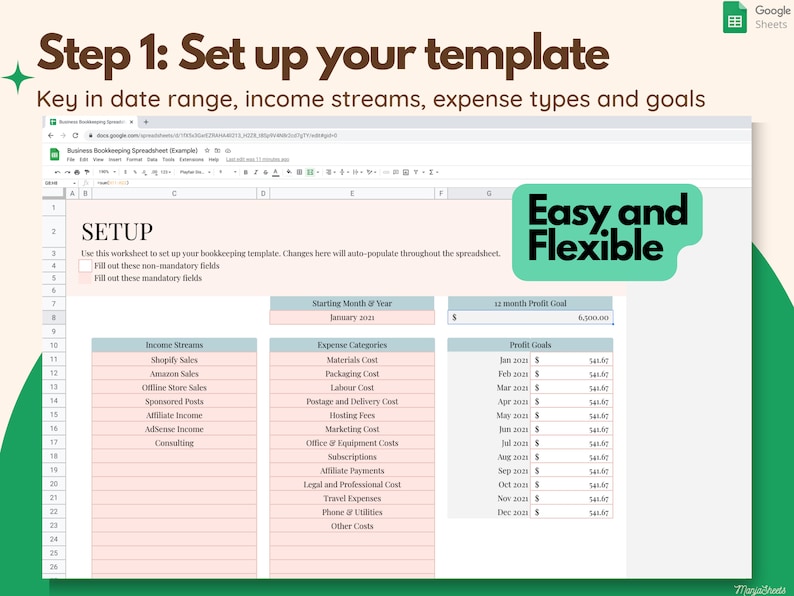

This All In One Bookkeeping Small Business Budget Spreadsheet helps you keep track of your business income, expenses, profit and inventory.

This is a Google spreadsheet with the following capabilities:

☆ Income Tracker to record and track all your business income streams (up to 20 different categories) and sales tax received

☆ Expense Tracker to record and track all your business expenses (up to 20 different types) and sales tax paid (and eligible for refunds in certain tax jurisdictions)

☆ Annual overview of your income, expenses and profits over the year

☆ Deep dive into a specific month’s income, expenses and profits

☆ Accounting to track taxes collected and paid by month

☆ Inventory template to organize and keep track of your materials and product inventories – items needing to be restocked will be automatically tagged

You will receive a PDF with instructions and links to the Google spreadsheets.

Experience: Our Cornerstone in Crafting Elite Accounting Solutions

In the world of accounting and bookkeeping, experience matters. It’s the backbone of a reliable and efficient financial system.

At BookyBalance, we take immense pride in the extensive professional experience that shapes our commitment to delivering top-tier accounting and bookkeeping solutions.

QuickBooks ProAdvisor Expertise:

What sets us apart is not just our experience but also our recognition as QuickBooks ProAdvisors.

This prestigious badge from Intuit QuickBooks demonstrates our in-depth knowledge and expertise in using QuickBooks, one of the most trusted and widely used accounting software solutions.

As ProAdvisors, we’ve been trained and certified to provide expert guidance and support to QuickBooks users, ensuring they make the most of this powerful tool.

Our Expertise:

Our journey began years ago, driven by a passion for precision and an unwavering dedication to helping businesses manage their finances with ease.

Over the years, our team has accumulated a wealth of knowledge, tackling a diverse range of accounting challenges. We’ve worked with small businesses, entrepreneurs, and seasoned financial professionals, understanding their unique needs and fine-tuning our skills to deliver top-notch support.

What Are The Features Of Our Accounting Templates

Income Tracker:

Expense Tracker

Enables users to record and track various types of expenses related to the business. It may support up to 20 different expense categories and help in monitoring sales tax paid and eligibility for refunds in certain tax jurisdictions.

Annual Overview

Provides a comprehensive annual summary of income, expenses, and profits, giving users insights into their financial performance over the year.

Monthly Analysis

Allows for a detailed examination of a specific month’s income, expenses, and profits, aiding users in identifying trends and making informed financial decisions.

Tax Tracking

If you’re selling taxable products and services, you can use QuickBooks Desktop to track sales tax collections and remittances for each state and tax authority. Sales taxes can be added to receipts, estimates, and invoices.

You can run a tax liability report for a certain time period and track tax payment due dates to avoid late filing and penalties. In addition, you can monitor what you owe from the Sales Tax Payable register and the Pay Sales Tax window.

![]()

Tracking tax liabilities in QuickBooks Desktop Pro

Inventory Management

Includes an inventory template that assists in organizing and tracking materials and product inventories. It may offer features to automatically tag items needing restocking.

QuickBooks Pro lets you set up inventory items so that you can track what you have on hand and how much you’ve spent and earned with it. When you sell a product, the program records both purchase (COGS) and sales revenue in a single entry. This helps you easily track and analyze your gross profit and gross margin and whether you are making enough money on a certain item to replenish your inventory. Also, QuickBooks will adjust your inventory in your balance sheet automatically, eliminating the need for manual data entry.

There are three types of items you can add in QuickBooks Desktop: noninventory items, inventory items, and services. Noninventory items are those you purchase but don’t track, such as office supplies, while inventory items are those you purchase, track, and resell. Service items are services you purchase or offer, such as consulting hours and labor fees.

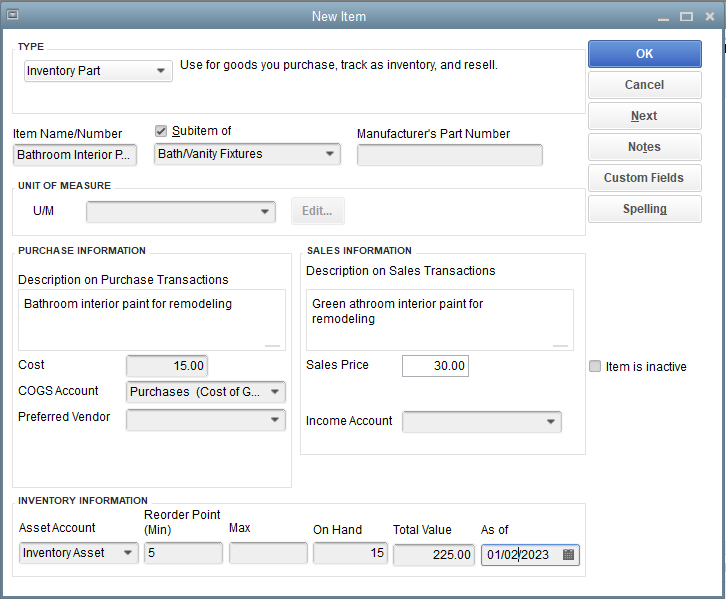

When recording an inventory item in QuickBooks Pro, select Inventory Part and then complete the New Item form that shows up. To set up new inventory, complete important details, such as item name, purchase cost and description, and sales cost and description.

One of the best parts about inventory in QuickBooks Pro is that you can set reorder points. QuickBooks will alert you to replenish your inventory when the item’s count hits the reorder point you specified.

Adding a new inventory item in QuickBooks Pro

Google Sheets Compatibility

The template is designed for Google Sheets, offering the advantages of real-time collaboration, cloud storage, and accessibility on various devices.

Digital Product

It is a digital product available for instant download after purchase, making it convenient and accessible to users.

User-Friendly

The template is designed to be user-friendly, catering to individuals with varying levels of accounting and bookkeeping expertise.

Professional Design

The template is professionally designed to ensure precision and efficiency in financial tracking and reporting.

Easily remit payroll taxes

QuickBooks Payroll tracks provincial and federal taxes and automatically fills in T4/RL-1 forms, making them simple to remit – even EFILE2.

Quickly pay employees

Simply enter hours and let QuickBooks Payroll do the rest.

Automatically stay up to date

We automatically send you payroll updates when they become available, so your tax tables are always up to date.

Customer Reviews